Psychology Book

You are welcome to view some of the chapters. Here they are below:

Introduction

I wrote this manual to help people make money in the financial markets. It doesn’t matter what you trade, be it currencies, stocks, commodities, warrants, options, futures, spread betting, CFDs, this manual is for you.

When I am not trading, or doing research on the markets, I help people who want to trade. I help them at whatever stage they are on. I help them to find a way out of the maze. I help them to go beyond their current reality and unlock their true abilities. If they will let me, I will push them beyond that.

Above all, if I had to condense the message in this introductory chapter, it would be that I help people to think differently. My friend Mark Douglas, who wrote “Trading in the Zone”, said in his book that profitable traders think differently.

This manual is inspired by my students, and it is written for them. It is inspired by my own struggles, past and present, and it is written from a desire to help more people than I can teach myself.

You may wonder why I write “…my own struggles, past and present”. You may think that I shouldn’t be writing a book about trading if I have struggles myself. In theory you are right. In reality you are not.

The trading mind is like a muscle. Like any muscle it needs nurturing and daily exercise. My struggles are most likely different to the struggles that a new-comer to the arena experiences, and they are not necessarily trading related. It could be something as simple as juggling the responsibilities of modern life (job vs. family vs. friends).

If you are already a profitable trader, then I want to congratulate you. You are doing something which very few people achieve consistently. It is a great place to be. You have no doubt worked hard at getting to this point, and you deserve to be here. Trading is in a sense a fair game. By and large there is a correlation between the amount of effort put into your trading and the amount of money taken out of your trading account.

However, if you are not quite where you want to be in your trading, even though you may be profitable, then this manual will help you. It will help you understand the most important component in your trading world: you!

I have no doubt that reading this manual, and taking on board the information within will enable you to

- Understand the markets better

- Understand your role in the markets better

- Enable you to make much better trading decisions

If you are starting out trading, this manual will be of enormous benefit to you. You will have a path to follow, something to aim for, and something to aim beyond.

If you are not consistently profitable, then reading this manual will make you understand why. I am certain it will guide you towards consistency.

The Why and the How

“The why” is more important than “the how”. If you know why something is happening, you are in a much stronger position to solve the problem than if you don’t know the source of the problem.

If you understand the nature of the “why”, then you will begin to understand the nature of yourself. Once you understand “your” part of the trading equation, you can begin to tackle the real hurdle of trading, which is yourself.

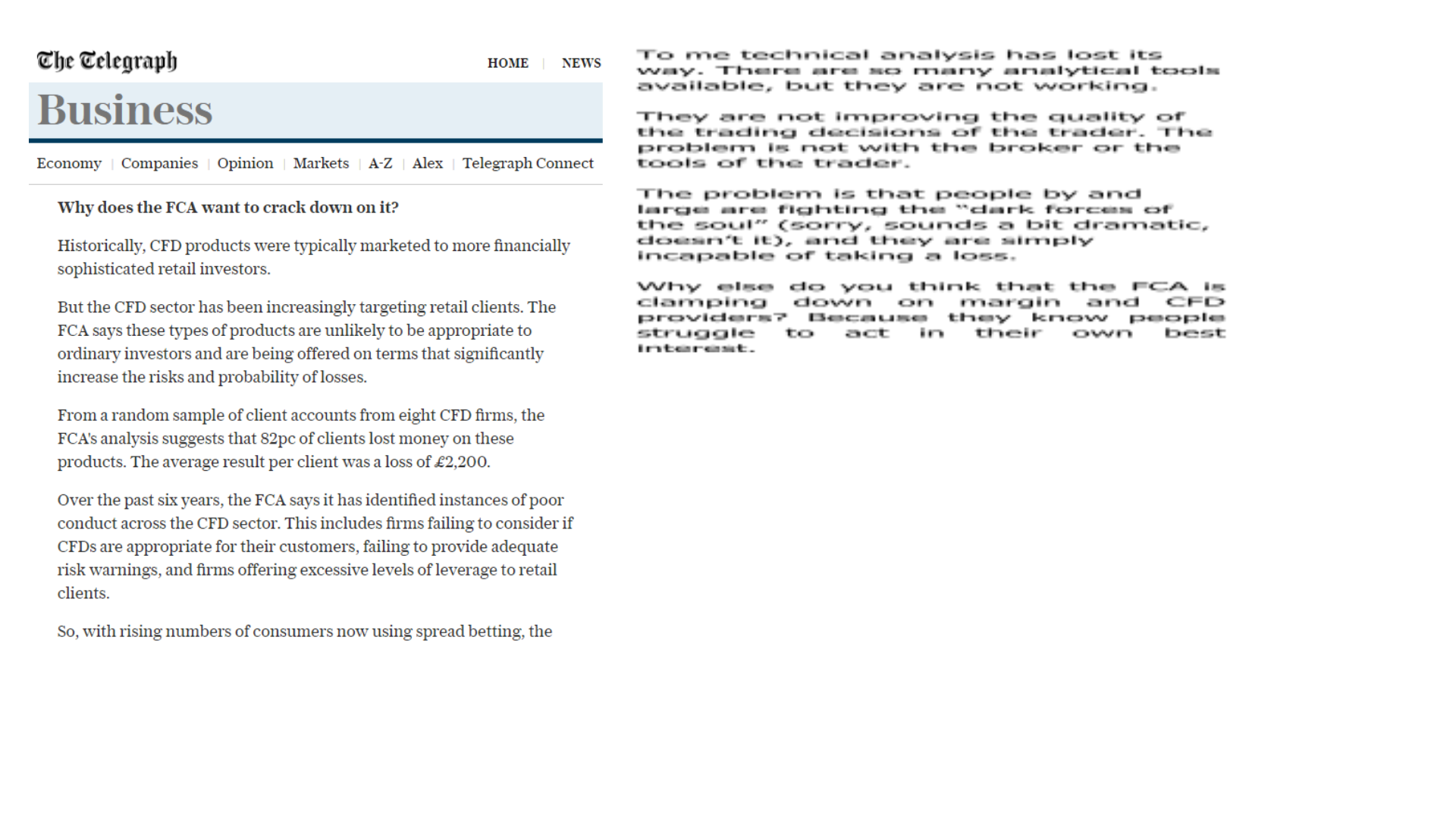

The lack of consistency in trading is not due to the software you are using. It is probably not because you don’t know enough about the markets either. It is not because you don’t subscribe to a guru newsletter, and it is not because you are using the wrong moving average or the wrong setting on MACD or Stochastic.

The lack of consistency is down to one thing and one thing only. I think you already know the “why”. You know that you are the weak link in your trading equation. Do you know the “how”? Do you know how to act in your own self-interest all the time?

Once you have read this manual, you will know why you are not making money consistently. You will have the knowledge to make the right changes and you will have a guided path to your new profitable trading life. It will have a huge impact on your trading.

No Sugar Please

This is a sugar free book. It means I have not sweetened anything. My own flaws and imperfections no doubt shine through the chapters here and there. You could even make the argument that I am not writing this manual for you, but for myself.

That is correct. I am cementing what I have learned from my trading career so far. I wish I had been able to get hold of a manual of this kind when I started trading. I would have saved myself a lot of money and a lot of heartache.

I have a lot of trading books on my bookshelf already. They never really lived up to my expectations. I recently sold 200 of them to another trader. I still have plenty of books and manuals taking up space and collecting dust. I doubt I will ever read any more trading books. I may be proven wrong, but if I do read another trading book, I doubt very much it will be one on technical analysis.

More analysis is simply not the path to more profit. Sure, they are some good books in circulation, but they are few and far in between. Most books are full of good theoretical advice.

They are written by well-meaning people, who have dedicated a large portion of their time, often their spare time, to write about trading. The problem is that they will have no real meaningful impact on your trading.

If it was just a question of advice and information, then we would all be wealthy traders. Unfortunately there is a lot LESS to trading than meets the eyes.

The Simplicity of Trading

Yes, that is right. There is a lot less to good trading than you think. Of course there are thousands of books and courses available world-wide. Some are truly awful. Some are a rehash of what the “guru” has read in a book about technical analysis. Very few offer a genuine path for a student to follow.

Why?

The answer is because so few have understood what successful trading, profitable trading, is about. They think it is about technical analysis. They think it is about software. They think it is about understanding what the “professionals” are doing, and what their “secrets” are.

Have you seen how many “professional” hedge funds underperform the market every year? If you have, then you will know that the professionals will have the same issues as you do. They are rarely better than you, but they do have much deeper pockets.

Alcohol and Cigarettes

On the 28th of September 1998, I stopped smoking. I had been smoking for 13 years. I had attempted to stop many times. I wanted to stop because I was coughing a lot, and I didn’t feel healthy. I had also noticed that my consumption of cigarettes had gone from “occasional” to “whenever possible”.

On my previous attempts to stop, I had tried everything: cutting down, smoking low tar cigarettes, wearing these nicotine patches, cold turkey, eating carrots instead, and every time I failed. It was hard to stop. The cravings were terrible. I felt beside myself when I didn’t smoke, and I was miserable.

When I started smoking again, I felt good momentarily. Then the remorse set in, and all the old feelings about smoking came flooding back, and I returned to square one.

On the 28th September 1998 I stopped once more, but this time I knew that I would succeed. I knew I would never smoke again. I knew that no matter what would happen in the future, nothing could make me want to smoke again.

What was the difference between this time and all the other times? The short answer: The right kind of preparation.

The alternative answer: Understanding the nature of cigarette addiction and having the right tools to handle the challenges.

I had been preparing myself for a month for that moment. I had read and re-read the “bible” on how to stop smoking. It was a 300 page book by Allan Carr, called The Only Way to Stop Smoking. It went into great detail about the nature of addictions, and how to break them.

When I stubbed out my last cigarette that afternoon on the 28th of September 1998, I knew I was free immediately. I knew I would be happy immediately. I knew every day would get better and better….. and it did.

15 years later I was still not smoking, but I was drinking more and more. I was unhappy with my consumption of alcohol. I think alcohol abuse is one of the great taboos of our world.

We look at smokers now with absolute disgust, but we think of people who drink a bottle of wine for dinner as happy people.

I had lost my job in the financial crisis of 2009, and I had decided to go solo. I traded for myself and I did much better financially than I had whilst working in London, but I was bored. I traded during the day, but in the evenings I didn’t know what to do with myself.

In the old days, whilst working, I had either done a seminar in the evenings, or I had stayed in the office watching the markets, but now I had lost the desire to sit in front of a screen for 12 hours a day. I had gone through a divorce and I wasn’t in a great place.

Alcohol is a great product to numb your pain, both physical pain and emotional pain. So I drank more and more. My juice was Jack Daniels. If they didn’t have Jack, I would drink other whiskeys. I think I would have drunk cow’s piss, if it tasted ok and I got a buzz from it. It wasn’t the whiskey I craved. It was the pain relief.

I don’t assume I am blessed with any natural abilities except for perhaps two qualities. I work like possessed when there is something I really want, and I am an introspective individual. I ask a lot of questions – aimed at myself. It is the latter quality that made me question what on earth I was doing to myself.

Once again I sought answers from other people. I went to AA, and I enjoyed speaking to the people there. I went there religiously for a few months and it helped. I realised I wasn’t an alcoholic. I was just a sad old lonely fart who drank a bit too much in the evenings.

So I started drinking a bit here and there, nothing big, just enough to be sociable. Unfortunately, it is a bit like smoking a bit here and there. Before you know it, you are smoking/drinking like you used to.

I found a book about alcohol by Jason Vale. He is a cool dude, who has written extensively about juicing and health issues. I read the book from cover to cover twice. Then I understood the nature of alcohol.

I stopped drinking that evening although I had prepared for a few months. As of today, the 8th of April 2021, I have not had a drop of alcohol since the 11th of July 2015.

I don’t need it. I am free. I have celebrated births, birthdays, passed exams, celebrated holidays, sung during the festive seasons, even cried tears of deaths, and I can say that not one of those events would have been made better (or less painful) by alcohol.

Freedom in Trading

I am not here to preach about tobacco or alcohol. It is frankly not my remit. So why am I harping on about how fantastic my life is without those elements in my life?

Take a look at the information provided by the government on how to achieve success in stopping smoking.

The headline says it all: Quitting is Hard.

I don’t think it was hard to stop smoking, once I understood what I was dealing with. Yes, I felt different, but I anticipated it. I was waiting for it.

I am writing this manual so you can experience total freedom in trading, and certainty that you can make money over time – without fear of losing money.

So why do I talk about tobacco and alcohol? I wasn’t successful in turning my life around until I understood the nature of the trap of alcohol and tobacco. I don’t think traders will make money consistently in the markets until they understand the nature of the markets.

Since the markets are nothing more than a reflection of the collective psyche of all the participants in the market, it stands to reason that you need to understand what drives people in the market.

I can attempt to understand everyone else in the market, but it doesn’t make sense to do so. Rather it makes much more sense to understand myself and what makes me do what I do.

I will answer questions such as:

Why am I not profitable?

Why do I get scared when I am trading?

Why do I do the opposite of what I planned to do?

Why am I not acting in my own best interest?

My Qualifications

You could justifiably ask what makes me so qualified to answer these crucial question about trading. If I listed my achievements then I am letting my ego talk. If I told you about my struggles in the past, I think you may pass the opportunity to learn something of great value by absorbing the messages from this book.

I trade every day, and I am very often in the public domain, through TV and radio, where my trades and investments are dissected. I train people how to trade and I even offer several trading courses myself.

I have in the past run a live trading room where all trades were made public in real-time. Those profitable numbers speak for themselves.

I am in daily contact with clients and friends who trade. I teach many of them personally. I have a very close first-hand exposure to trading and trading education.

When I am not trading and watching the markets, I am writing about trading and teaching the subject. If anyone would know about trading and teaching trading, it would be me.

95% of People

I read on Google that 95% of all books ever purchased were never read completely. That is about the same percentage of people not making money trading.

I hope for your own sake that you will find the motivation to complete this manual, because I know that IF your motivation is to make money trading, then you will have the answers by the final chapter.

You will be in trading where I was with cigarettes and alcohol years ago. You will KNOW that you are going to make it.

Is it easy to learn to trade?

Is it easy to learn to trade? I will give you 2 answers:

Answer 1:

Yes, it is very easy to learn to trade. You either click “buy, or you click “sell”, or you do nothing. That’s pretty easy.

Answer 2:

Yes, it is very easy to learn to trade, but it is a big challenge to become a consistently profitable trader.

The goal of trading is to be consistently profitable. The goal is to take money from other traders and bring it home to your bank account. When you buy a market, SOMEONE has to sell it to you. When you make £1, someone has to lose the same amount. It may be the anonymous crowd, or it may be the broker.

This is the reason why not everyone can win in the game of trading. It is not designed for that. The mechanics behind trading is easy to master, but the road to profits is illusive, and the profession itself is a very challenging occupation to master.

This manual has one purpose: I want to guide you into the small group of people who make money consistently. It is akin to a manual on how to fix a practical problem, such as repairing a flat bicycle tyre.

Why is this manual different to any other books and manuals that you have read about trading? The answer is simple. In this manual I am not writing about the best indicator or the best time frame to trade. I am not throwing old clichés at you either.

For example I am not going to tell you to let your profits run. That would be treating you like a child. I think you know what you have to do already, just like a junkie knows he has to stop shooting up.

Instead I am going to explain to you why you are letting the losses run. You will understand what is going on inside your head. I will show you where things go wrong and why they go wrong.

When you see for yourself what traders in general are doing, you will have a very strong understanding of what the problem of trading is.

Armed with this understanding you will sit down in front of the trading screen and you will see trading for what it really is. You will have a strong drive towards the correct way of trading, even though it won’t feel like the right thing to do.

It will make for uncomfortable reading, but it will make you money once you start using it. You will probably recognise yourself in these pages.

I am so fortunate to have worked on a trading floor where I saw millions of trades every month. I have also seen thousands of trading records from my clients as part of my job to help them become better traders.

I am very good at shaping “not quite there yet” traders into “performing” traders. As part of that process I have to see what they are doing wrong. That means handing over their trade records.*

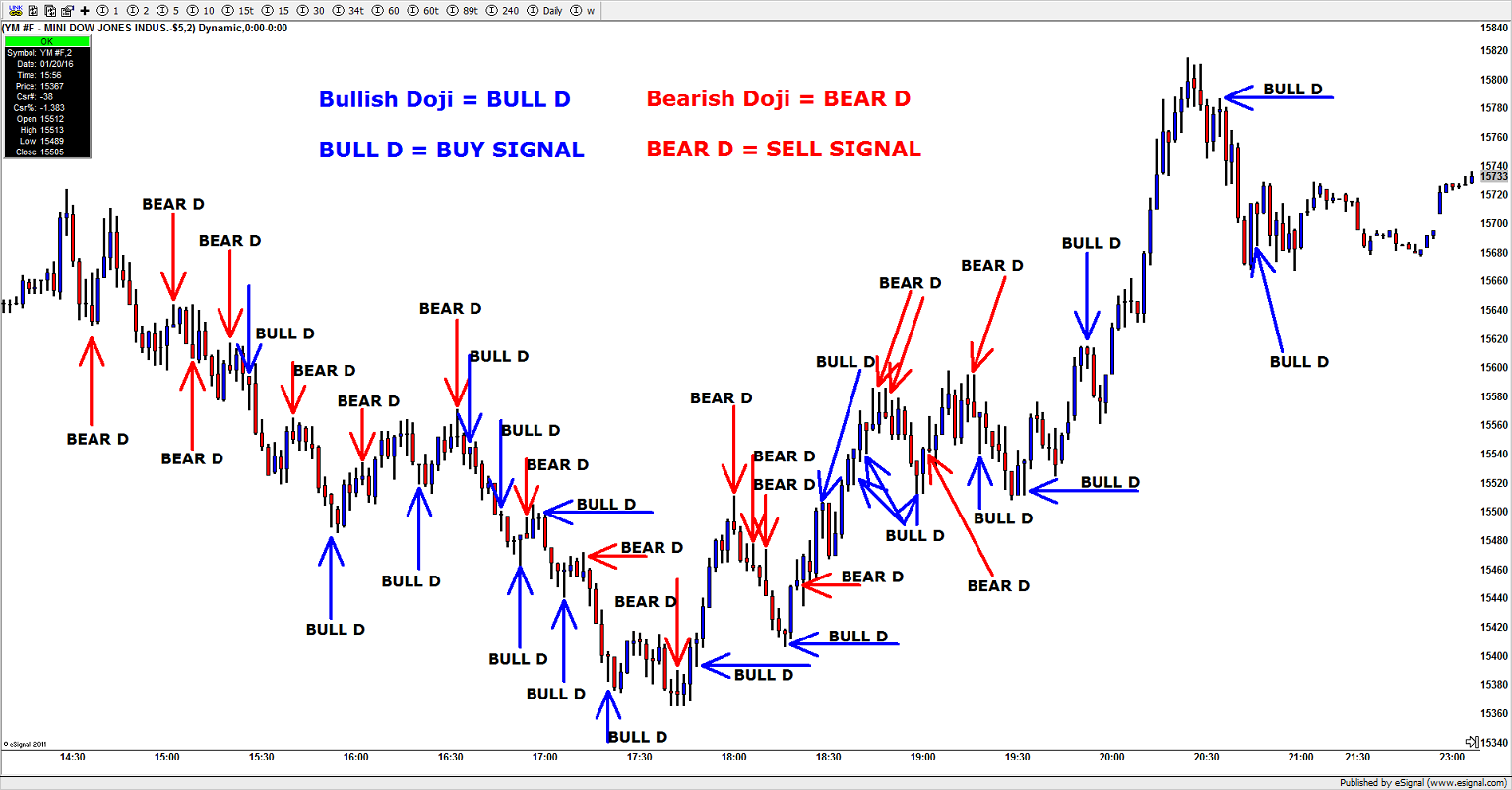

It is said that people learn differently. Some learn by listening. Some learn by doing. Some need to see it done before their eyes to learn efficiently. My theory is that those who are attracted to trading using graphs (you can call them chart traders) have a preference to learn visually. It means that their learning experience is optimal if they can see the concept described visually.

For example, if a trading mentor says: “Cut your losses quickly”, the student may understand this concept theoretically, but once he or she is in a trade, there is no connection between the statement and the price action unfolding in front of the traders eyes. The learning hasn’t manifested itself into a beneficial and automatic behaviour.

However, you don’t need to be a chartist to trade with huge success. You don’t need to know about charts to get the message from this manual. You don’t even need to keep an open mind. What you need to do is to keep reading until the last page.

In this manual I am showing you visually what happens when a trader over-trades, when he cuts his profits quickly, when he lets his losses run out of control. These are real trades, made by real traders, who were struggling before I got involved with them.

Who are my clients? They come from all walks of life. There is a big portion of self-employed entrepreneurs as part of my clientele. They are financially incredibly successful in their other endeavours. They are attracted to trading for all the right reasons, but they are often incredibly frustrated by the fact that they are not able to replicate the successes from their other professional work in the trading arena.

Put more poetically, they are frustrated by the “disconnect” between their expectations in the markets and their results. They see what is possible in the market, but they are not able to capitalise on it.

What’s in it for me?

When you write and teach, you learn yourself. Just because you have arrived to where you want to be doesn’t mean you can start relaxing. You work consistently to get there, and you work consistently to stay there, or to get better.

This manual, believe it or not, started as an article of a few pages. It was meant to address a trading issue, but one thing led to another and 150 pages later I finally felt I could hand it over to the editors.

There is another reason why I wrote this manual. I wanted to give something back, in return for all the help I have received from mentors. My big trading hero is Paul Tudor Jones.

He is among the top 5 best traders and hedge fund managers in the world. Outside of his trading he runs his Robin Hood Foundation. He helps underprivileged kids in economically deprived areas in America to get a scholarship to colleges. I am in awe of Paul, for his trading abilities and for his generosity with his time and money.

Yet another reason for writing the manual is that it gave me a relief from trading. It can be mentally taxing to concentrate for long hours every day, and you are not guaranteed any rewards. You eat what you kill, so to speak. It often requires a tremendous amount of patience, and sometimes trading can be very boring.

Think of an actor filming a blockbuster movie. The movie Titanic is 3 hours long. It took 160 days to film. They filmed a minute a day on average. It is a long time to sit around or getting ready, only to shoot a scene lasting 1 minute. I am sure actors are at work for 8 hours a day too. Like acting, trading requires a lot of waiting around.

When trading is going well for us, it seems like the easiest thing in the world. You buy something. It goes up. It is sometimes as easy as that. You sell it, and you happen to sell right at the top. You feel like a super star. The money is flowing into your trading account. You are living the dream.

When you are there, you think it will never change. You think the good times will carry on. You can’t contemplate it ever changing. If you have had a “slump” during your trading life, and you come out of it, you say to yourself: “I have cracked it, cracked the code of the markets, and things are different now”.

When the “slump” happens again, you wonder what you have done to find yourself back there. You ask yourself why you are losing money doing the same things as you did when you were successful.

A good trader friend of mine calls these phases the “pay-in” and the “pay-out” phases. When you are in the “pay-out” phase, the money rolls into our accounts without effort, and you collect big pay-outs.

When the “pay-in” phase occurs, you keep funding your trading by paying money into your trading account.

Why is this happening? You will find the answer to this conundrum in the manual. I promise you that I will do my best to keep it entertaining throughout but remember: this is an instruction manual.

If you want my help after reading this manual, then send me an email. I run advanced trading strategy courses as well as intermediate courses. If your goal is to become a profitable trader, then I can train and guide you to this outcome.

You are also welcome to send me feedback on this manual.

My email is [email protected]

Happy trading

Tom

30th January 2017 – London – UK

*All client names mentioned in this manual have been changed to keep clients identity anonymous. All trading records are used with the explicit permission of the clients. Trading sizes may have been changed at the request of the clients to further protect their identity.

A Typical Trader

From time to time I do private mentoring for clients who want to learn how to trade properly and, above all, profitably. Much of the material for this book comes from my work with them.

When I worked in the financial district in London, I would teach clients of other brokerages. I guestimate I have done more than 1500 speeches and training sessions about trading in my career. I imagine it means I have spoken to more than 30,000 people, although I am certain I saw some of the same faces more than once.

This manual is also based on my work with them, their questions and my own experiences as a trader, as well as the years spent on a trading floor in London.

I am going to kick off this manual by writing about a client I have been coaching. I think his story will serve as a great place to start your trading journey to consistency.

John works in central London. He is one of London’s most successful real-estate brokers. I don’t know his financial circumstances, but when I look at him pulling into my drive in his beautiful brand new Jaguar F-Type Coupe, I think of a man who has done well financially in life.

John is a great guy. He smiles all the time, and he is a real pleasure to be around. He is polite, very astute, and we get on well. John loves the markets, but after spending a couple of years not really getting anywhere with his trading, he took my trading course.

Subsequently he came to realise that the problem wasn’t so much his ability to read the charts and the patterns. In fact he thought he was quite good at predicting where the market was headed.

However, he was frustrated. He lost more when he was wrong than he made when he was right. In other words John had the knowledge, but the knowledge didn’t materialise into money on the trading account.

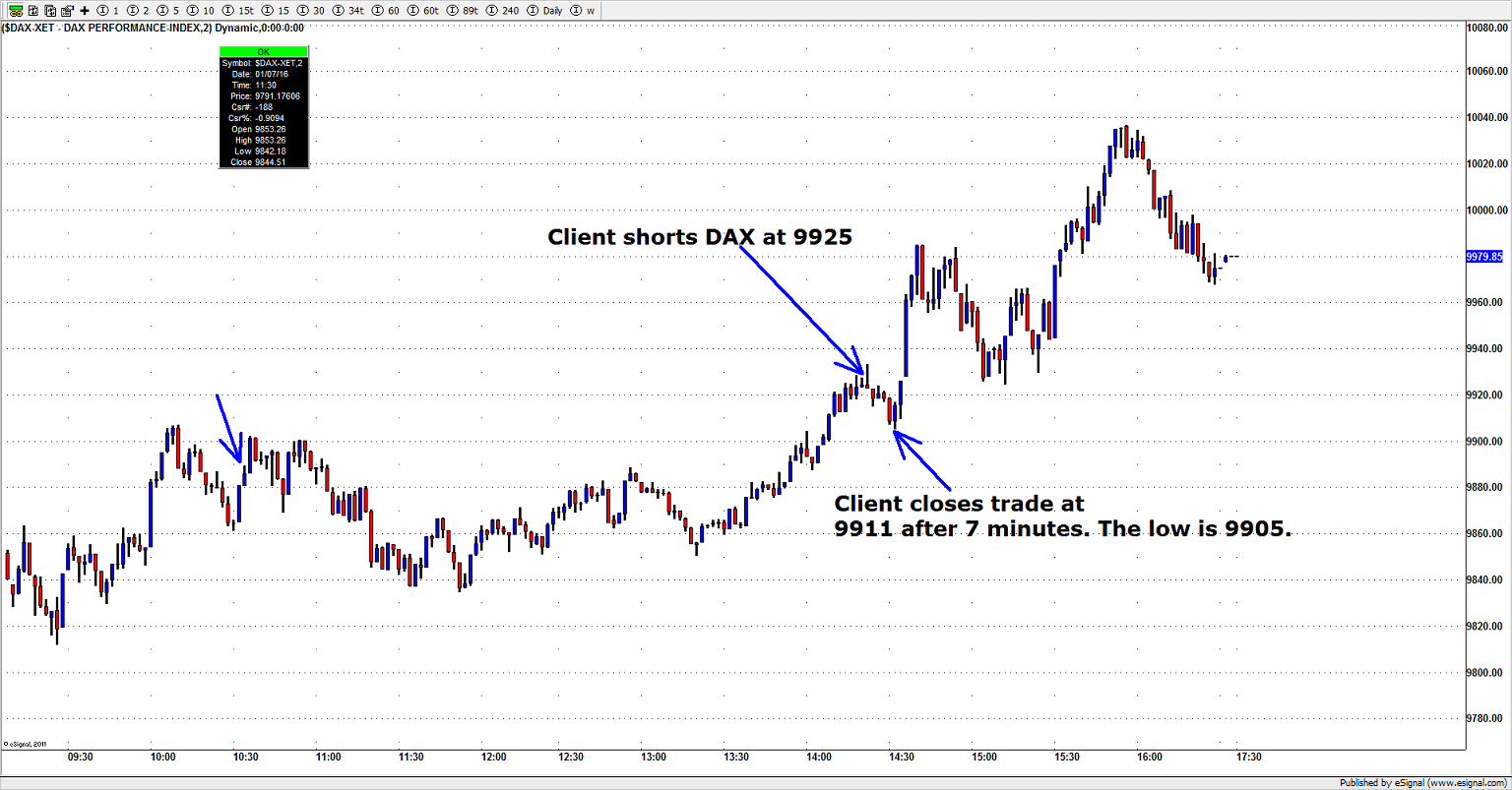

John was not in a great mood today and he wasn’t smiling as much as usual. He was upset that he had not been able to capitalise on a great and volatile trading day in the German DAX index the day before.

Tom: What’s up John? You seem unhappy.

John: Ahh, just frustrated. The Dax index yesterday was perfect for my trading style. There were a lot of signals, yet somehow I end up doing exactly the opposite of what I planned to do.

He ended up losing a lot of money even though he had seen the signals as they happened.

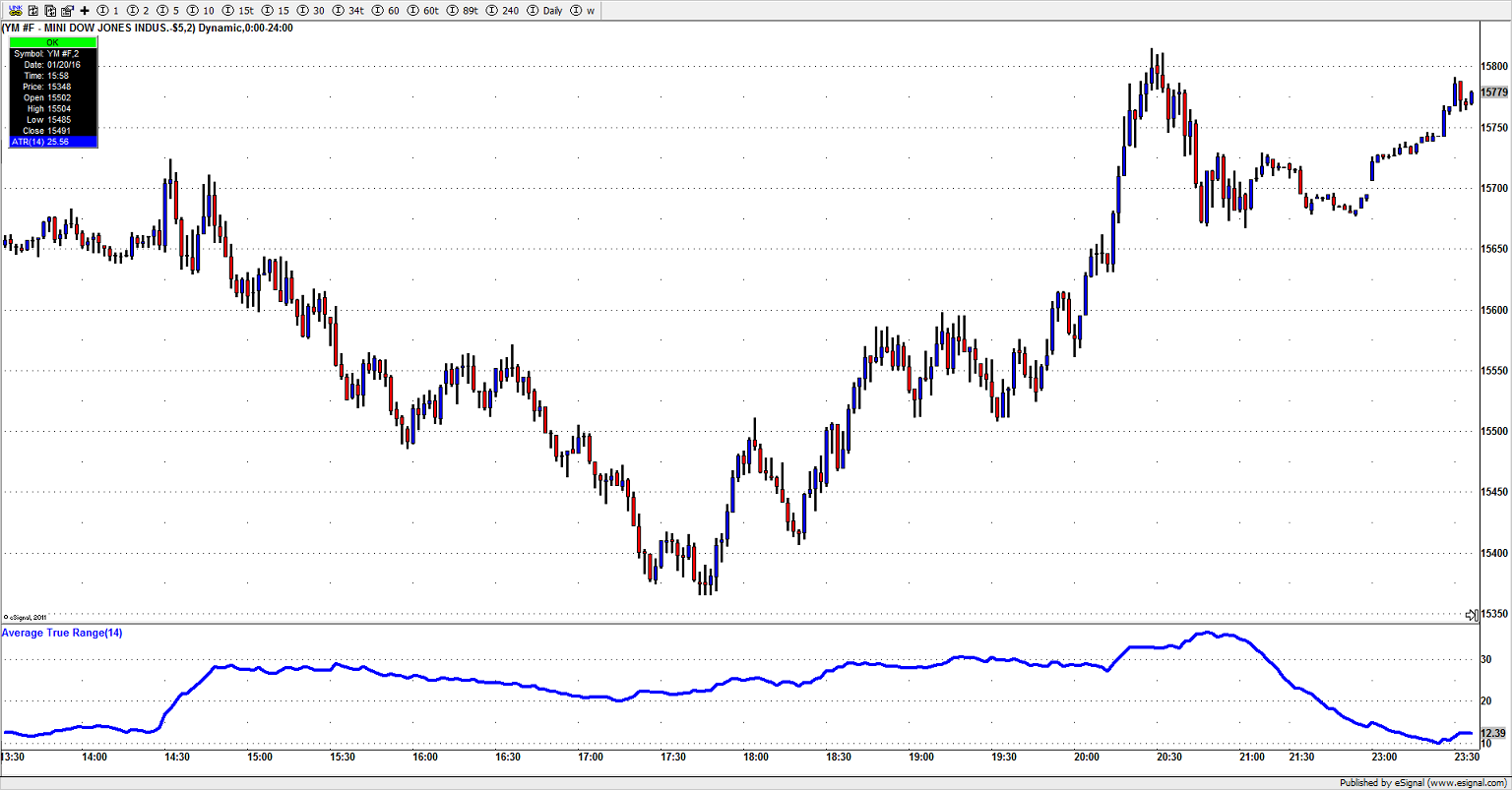

We decided to go through all his trades, one by one. As you can see from the chart on the next page, it was a trading day with plenty of swings intra-day.

John’s trading statistics for the day looks at follows:

Trade trades: 28 trades

Winners: 9 trades Losers: 19 trades

Total Won: 170 DAX points Total Lost: 376 DAX points

Average points won: 18.8 Average points lost: 19.8

These numbers do not look great, but I am not overly bothered about the amount of winners over the amount of losers.

What I am more interested in is how much he wins, when he wins. I am also interested in how long he holds his winning trades and how long he holds his losing trades.

CHART NO 1: DAX Cash Index 7 January 2016 – The market opened weak and continued to trade lower until 9am. The first hour was a classical trend move. All rallies failed in the first hour. After the first hour the market found some buyers. It traded sideways in a 60 point range for the next 4 hours. One hour before the US market opened, the DAX index broke up through the morning high and climbed higher the rest of the day (160 points).

Average points won: 18.8 Holding time winners: 10 minutes

Average points lost: 19.8 Holding time losers: 32 minutes

I can see that John makes and loses about the same on his trades. This in itself is an important piece of information. Most newcomers will lose more on average than they win. In this sense John is ahead of the curve.

What is important for me to establish is that John displays a classic pattern of holding his losing trades longer than his winning trades.

CHART NO 2: Shorting the DAX – Client shorts the Dax on a small retracement during a heavy sell-off.

John sells short the DAX. That is a brilliant trade and it makes sense to sell into any short-term strength on a weak open. The market is under heavy selling pressure. All related markets like Dow and FTSE are selling off heavily too.

John closes the trade 40 minutes later. I asked him why? His answer gave me an instant insight into what he needs to work on to change his trade statistics.

John: I closed the trade because I saw the market move against my profit. I was concerned (Concerned = scared) that it would take more of my profits away. I was happy with 44 points. I usually only make 15 to 20 points.

So I asked him how he felt when he saw the market then move 68 points in his favour after he had closed the trade.

John: I was really happy after I closed the trade. I regretted closing the trade shortly after. In fact the moment I closed the trade, I realised I was doing something out of emotion rather than logic. All my joy from the winning trade disappeared when I saw the market move much lower.

I asked him if there was anything on the chart at the time of his exit that suggested that the market was headed back up again. He said there was nothing on the chart that suggested that it was more than a temporary counter-move.

I asked him if he regretted getting out of the trade.

John: When I am in the trade, I am very scared that the profits will disappear. When I close the trade, I am immediately filled with regret.

The joy of the winning trade was replaced with despair when the market continued in my favour, but without me in the trade. I think the anger of getting out for no reason outweighed the joy of what I had made on the trade.

John didn’t trade for the next hour after he missed the 68 point move. He was so unhappy that he had missed out on that big move lower. About one hour later he noticed a pattern.

It seemed to be a rising low and a rising high on the 2 minute price chart. He decided to buy the DAX, even though the trend was strictly speaking down (Chart 3).

Seconds after John bought the DAX, the index spiked higher. He was so excited that he closed half his trade immediately. He let the other half run. 8 minutes later John closed the other half for 25 points more than the first half. He told me that he was happy he had kept half his position open.

CHART NO 3: Buying DAX in a down-trend – Client buys the Dax after a series of higher highs and higher lows on a small time-frame.

The dialogue that followed tells me a lot about the mind-set of John, and incidentally about most traders:

Tom: Why did you close half the position?

John: I wanted to protect what I had earned.

Tom: Why didn’t you close all of it?

John: I thought there was more upside.

Tom: If you think the DAX is going to move higher, then why do you close some of your position? I understand that you want to take profits if you think the move is over or if you think the market is exhausted.

In your situation this is not the case. You think there is more upside, but you still reduce your position. Why is that?

John: Not sure.

Tom: There must be a reason why you do something against what you believe. You believe one thing but you are doing another thing. You believe the market is moving higher, but you trade as if the market is not moving higher.

What is it you are feeling at that moment before you close some of your position? You should be happy that the market is agreeing with you. You are not in a losing position. You are making money. The market is agreeing with you.

He snapped:

John: FEAR………….. I am afraid that my profits will disappear.

Of course this is what I wanted him to say. I wanted him to admit to himself that he was scared his profits would disappear, but he was careless with his losers, as you will see later.

I suspect John was beginning to realise that profitable trading goes way beyond what he thought it would be. He thought that profitable trading was about learning some great trading setups and then repeating them over and over. Of course we need setups, and we need strategies, but they don’t guarantee profits.

People enter the trading arena with great expectations and they usually leave frustrated and poorer for the experience. The great paradox of trading is that it seems so easy and straight-forward, but it actually exposes you to your own weaknesses and frailties.

Most men and women fail in the trading arena because they would rather turn their back and walk away than to go through the pain of resolving their issues.

I have stated if before, and I will state it again: there is fairness in trading. Those who put in the hours and work on themselves as much as they work on the markets will succeed.

John’s next trade came immediately after. He goes short the DAX. He said that he still felt the overall market was headed lower. He had wanted to find a place to sell short the market, and now he felt this was the right place to do it.

The trade entry was amazing. John more or less sold short right at the top of the move. I didn’t ask him why he shorted it there.

CHART NO 4: Selling DAX short – Client decides the bigger trend is still down and he uses the strength in the index to go short around 10am. The entry is perfect.

John takes his profit 2 minutes later. I asked him why he decided to close the trade. The following conversation ensued.

John: I thought the market was going to move back up again.

Tom: But only 2 minutes earlier you thought the market trend was down and the market was under pressure. What happened in those two minutes to change your mind? The market did move lower as you had expected. In fact it moved lower by 25 points. You got 6 points.

John: I guess I wanted to protect my profit. The market had moved 10 points in my favour, and then it moved against me, and my profit was only 2 or 3 points. When I saw that I could close for 5 or 6 points profit, I just did it.

John is not abnormal in this sense. On the contrary he is just like everyone else. I have seen millions of trades executed by tens of thousands of traders. John is conforming to the great majority.

Almost every single person trading are prone to fearful behaviour when the market threatens to take away something you have already received – i.e. accumulated open profits.

You will see later that John has turned the world upside down. At the time when he is supposed to be happy that the market is moving in his favour, he is full of fear.

When the market is moving against him, he is actually in a state of ignorant blissful hope. It would make far more sense that he was hoping when things were going well, and he was fearful when things went against him.

Unfortunately this is not the way our minds work, unless we train it to think this way. To hope for something is an incredibly powerful emotion. It can feel good to hope. It can make us believe in things that may seem illogical. To hope a losing trade will turn around is as normal as to hope that tomorrow will be a sunny day – even if the weather forecaster says it will rain.

Have you ever been face to face with a barking dog, showing its teeth? Would it make sense to hope that all would work out if you just closed your eyes and pretended all was well? Well, maybe it will. Maybe it won’t. I am not sure what the options in this situation are anyway. At least with trading you can walk away.

Have you ever been to a party where you are the centre of attention, and everyone loves you, and yet somehow you are afraid that it will go away? Maybe it was your birthday or your wedding day and everyone was there to celebrate you.

I doubt you have ever felt scared in the midst of the best celebration. Instead you have been incredibly happy and you have enjoyed every moment of it. Of course you know the party will come to an end at some point, but you don’t entertain that thought whilst you are enjoying yourself. Why would you?

Yet, when you are in a winning trade, your thinking is turned upside down. It doesn’t make sense, does it? And that is exactly the point I am trying to make.

Trading goes against our rational and logical minds. If you want to turn your trading into a profitable enterprise, you need to learn to deal with a mind that actually works against you when you are trading.

Our minds are simply not designed for optimal trading. My mind is not designed to logically deal with the pressure of speculation, simply because it will be prone to do the wrong thing at the wrong time, in order to minimize fear and pain.

If this is true, then how does it work when millions of minds come together and interact with each other? Carry on reading and you will discover the answer!

We will return to John’s trading later in the manual. Right now it is time to take a dive into the world of our minds, and the research that has been unveiled into how our minds work when faced with uncertainty.

The Brain and Economics

I have a friend who is beyond clever. It is rather intimidating to be in his company. Have you ever seen the hit-series “The Big Bang Theory”? Well my friend Christopher is on par with Sheldon on that TV show.

He is also incredibly funny and he takes himself very lightly, a quality I greatly admire in a person who towers above everyone else in the IQ department.

Christopher has worked with the Nobel Prize laureate Daniel Kahneman, who is famous for his work in the field of behavioural economics. This area of economics studies the human emotions in the context of economics. I seem to remember the Latin meaning of “economics” as “the allocation of limited resources”.

Behavioural Economics is the study of how humans allocate and make choices, under different circumstances. For this manual the focus is to uncover the idiosyncrasies of the brain, which results in poor decision making in trading.

Feeling Good

As a warm up to understanding the problem with trading, I would like to recall a conversation I had with a friend who trades for a living. I asked him the following question:

Imagine you are asked to put a number to the intensity level of your emotions as a result of an event. It doesn’t matter if it is a positive outcome or a negative outcome. I just want to know how high you rate the outcome, between 0 and 100.

Zero means no emotional reaction, while 100 is the most extreme reaction you can possibly imagine. You are welcome to join in and rate the scenario yourself.

Scenario 1

You are trading, and you are on the wrong side of a very sudden news flash, which moves the market significantly. Your stop-loss is not triggered and you lose £5,000. This represents a significant amount of money to you.

In the afternoon you happen to get in early on a big move, and the loss from the morning is recovered. You make £5000 back.

What is your emotional intensity number?

Level of emotional intensity: _ _ _ _?

My friend answered 60. He argued that it was unfortunate that he had lost £5000 but he would be “above average happy” that he had recovered the money at the end of the day.

Scenario 2

You have a great morning trading and you make £20,000. In the afternoon everything goes against you and you lose £20,000. What is your emotional intensity number?

He answered 90.

I asked him why he rated the same outcome differently.

“In both cases you break even”, I said. Nothing has been gained and nothing has been lost, when all is said and done.

My friend replied that he felt it was worse to be ahead for the day and then give it all back. He felt that if he was down a lot in the morning, and he made it all back in the afternoon, it was an accomplishment.

Believe it or not, but it is in this story we begin the journey to successful trading.

Before you read on, look up this YouTube: search “Greg Riba”.

Sadly you are looking at one of the best and biggest floor traders ever, past tense. The story behind Greg Riba is incredible, but for now, listen to what he says about trading:

The Brain and Uncertainty

In Behavioural Economics researchers have studied how people choose between alternative scenarios under uncertainty. This theory, known as Prospect Theory, uncovers how people make irrational decisions depending on the risk associated with the outcome.

After my conversation with my trader friend I sent my friend Christopher an email which read as follows:

Dear Christopher,

When Kahneman proposed and investigated his Prospect Theory, did he give thought to the order by which the participants were able to choose a negative outcome vs. a positive outcome?

The question is based around an argument I have with my trader friend. We are debating the impact of our trading day, when the first few trades go well, as opposed to when the first few trades go poorly. If you end up with a complete status quo, I am questioning why my trader friend puts more emotional intensity to going from good to bad, than from bad to good.

Unbeknownst to my trader friend, I had asked him a near identical question a month earlier, but I had put the scenarios in the opposite order. Back then his answer was 90 and 95.

My thinking here is that my colleague, the emotional creature that he is (I think we all are), conform to the Prospect Theory, but when I change the order of the question, I get a significantly different answer.

Put in a different format: when bad news follows good news, you get a different result than when good news follows bad news.

Why is this important?

My argument is that most traders who experience a big loss very early in the trading day will be inclined to trade recklessly to get it back. Conversely a trader who has a big win early on will play cautiously for the rest of the day.

Some context is in order:

Imagine I am trading, and I am down $50,000 dollars during the first hour. I now fight my way back into the light and, by the end of the day, I am back at zero for the day. I will feel an enormous sense of achievement. I was down big time, and I made it all back. I may not have made a penny, but I feel elated, and I may even be happy.

Now imagine, I am up $50,000 in the first hour of trading, but by the end of the day, I have lost it all. Am I likely to be in a good mood? No, I am not. I will annoyed and not in a good mood. The day will feel like a losing day.

Hope you are well. Kind regards, Tom

Hey Tom,

Kahneman did give thought to the order of events, albeit it wasn’t captured as “order” per se. The order, we might refer to as “framing“* and we process these events through a concept referred to as “mental accounting,” effectively putting losses and gains in different buckets, despite it all being fungible.

This stuff falls under behavioural finance, which Richard Thaler is probably the better source.

http://www.nber.org/papers/w9222.pdf

(Section 3.2, page 19, on prospect theory actually proposes an example based on order, i.e., framing)

The other things to consider for your example are heuristics* — availability bias and anchoring in particular.

The bottom line is that these concepts and cognitive biases sort of overlap and interact with one another. It’s not as clear cut. It gets very messy. But through the mess, it’s quite clear we’re all f##ked up 🙂 ☺

Hope this helps? Let me know if I can provide more clarity.

https://www.princeton.edu/~kahneman/docs/Publications/prospect_theory.pdf

Chris

Framing Effect

Choices can be worded in a way that highlights the positive or negative aspects of the same decision, leading to changes in their relative attractiveness. This technique was part of Tversky* and Kahneman’s development of prospect theory, which framed gambles in terms of losses or gains.

You will find the framing effect at play in all walks of life:

# The drug will kill 10 out of a 100.

# The drug will save 90 out of 100

*Amos Nathan was a cognitive and mathematical psychologist, a student of cognitive science, a collaborator of Daniel Kahneman, and a figure in the discovery of systematic human cognitive bias and handling of risk. Much of his early work concerned the foundations of measurement. His early work with Kahneman focused on the psychology of prediction and probability judgment; later they worked together to develop prospect theory, which aims to explain irrational human economic choices and is considered one of the seminal works of behavioural economics. (Source: Wikipedia).

# The meat is 5% fat

# The meat is 95% lean.

# If you do this, you will receive a £5 award

# If you don’t do this, you will receive a £5 fine.

The framing effect is an example of cognitive bias, in which people react to a particular choice in different ways, depending on how it is presented. My trader friend is a relevant example. This led researchers to conclude:

- People tend to avoid risk when a positive frame is presented but seek risks when a negative frame is presented.

- Gain and loss are defined in the scenario as descriptions of outcomes (e.g. lives lost or saved, disease patients treated and not treated, lives saved and lost during accidents, etc.

- Prospect theory shows that a loss is more significant than the equivalent gain.

- A sure gain (certainty effect and pseudo-certainty effect) is favoured over a probabilistic gain.

- A probabilistic loss is preferred to a definite loss.

Example:

When you are given the choice between a certain win of £100, vs. a 50/50 bet between 0 and £200, 95% of the population will pick the certain £100.

When you are given the choice between a certain loss of £100, vs. a 50/50 bet between 0 and £200, 95% of the population will pick the chance to lose nothing, with the risk of losing £200.

Implications

Considering the high percentage of people entering the trading arena who fail to realise their dreams and ambitions of returning a profit from their time and effort, it is logic to draw the conclusion that we as traders need to combat our natural urges and inclinations when trading. We are simply not hard-wired to trade well.

As with most things in the arena of self-improvement, first come an awareness of our short-comings, then comes the dedicated practise towards improvement.

Amos Tversky and Daniel Kahneman explored how different phrasing affected participants’ responses to a choice in a hypothetical life and death situation in 1981.

Participants were asked to choose between two treatments for 600 people affected by a deadly disease.

- Treatment A was predicted to result in 400 deaths.

- Treatment B had a 33% chance that no one would die but a 66% chance that everyone would die.

If you work through the numbers then

Treatment A will result in 400 deaths – 200 survives

Treatment B will result in 396 deaths – 198 survives

This choice was then presented to participants either

- with positive framing, i.e. how many people would live

- with negative framing, i.e. how many people would die.

Treatment A

Treatment A was chosen by 72% of participants over treatment B, when it was presented with positive framing (“saves 200 lives”).

Treatment A was chosen 22% of the time over treatment B, when the same choice was presented with negative framing (“400 people will die”).

The framing effect has a huge impact on how people make decisions. People tend to be risk-averse: They won’t gamble for a gain, but they will gamble to avoid a certain loss (e.g., choosing Treatment B when presented with negative framing).

This effect has been shown in other contexts:

93% of PhD students registered early when a penalty fee for late registration was emphasised.

67% of PhD students registered early when offered a discount to do so.

In the context of trading this is relevant as we have a tendency to shy away from painful choices and favour positive choices. This may be exactly the wrong thing to do in trading. We will now have a look at how this reality can affect traders.

We will focus on “Hit Rate”, the percentage of winning vs. losing trades.

Hit Rate and Prospect Theory

When I teach trading strategies, I am frequently asked: What is the hit rate of this strategy? How many trades out of 100 trades will I win?

When I am asked this question, I do my best to make the person understand that “hit rates” is one of the most misunderstood and detrimental concepts for a new trader to focus on.

Prospect Theory, proposed by Kahneman states the following:

“Prospect theory is a behavioural economic theory that describes the way people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are known.

In economics and decision theory, loss aversion refers to people’s tendency to strongly prefer avoiding losses to acquiring gains. Many studies have conclusively established that losses are twice as powerful, psychologically, as gains.”

The important word here is TENDENCY. We will want to trade strategies that have high % chance of winning. This is what we seek out. If our emotions are left unchecked, then we have a tendency to follow the path of least resistance.

I should have written that last sentence as follows:

We have a tendency to follow the path of the least pain.

If our emotions are unchecked, then we will do whatever it takes to avoid any kind of emotional pain and discomfort. That is human nature, and that is what works against us when we are trading the markets.

Our minds are designed to move away from pain. It is for this reason that success doesn’t come so readily in any endeavour, because you have to endure something beyond the point where the crowd gives up.

What follows below are the trading records of two traders, who are on opposite sides of the scale of trading competence.

My client and friend Christian, who trades Euro Dollar and Dax index, is a good trader. He questions everything he does, and he works hard at getting better.

He is a profitable trader, although he is not content with his performance.

I have him tracking his performance meticulously to make sure he is aware of his behaviour patterns during the day. His statistics for the month doesn’t reveal a super trader, but he still made nearly £12,000 in one month.

His statistics reveals a trader who has more losing trades than winning trades. He traded the DAX 343 times and he lost on 53% of the trades. He lost on 55% of all his Euro Dollar trades.

This may not sound so great in your ears, but he is a great example that you can make money from trading with a 50/50 system. Everyone is obsessed with the “hit-rate” of systems. What that obsession really reveals is a FEAR of failure.

| Trades | Losers | Winners | Net P&L | Time in Losers | Time in Winners | |||

| Euro Dollar | 68 | 38 | 30 | £1,387 | 38 min | 131 min | ||

| Dax Index | 343 | 181 | 162 | £10,378 | 55min | 73 min |

There is a clear tendency to stay with the winning trades for longer than the losing trades. In Euro Dollar he is not particularly profitable, but he has more losing trades than winning trades, and he still ends in profit.

That is a hallmark of a quality trader.

The second trader has a much better hit rate than Christian. His name is Kevin. His story is not an unusual one, although Kevin is a little more extreme than most people in his trading. He had traded for a while when he came to me. He said all the right things during our conversations, which made me question why he wanted my help in the first place. Then I saw his trading statements.

| Trades | Losers | Winners | Net P&L | Time in Losers | Time in Winners | |||

| Dax Index | 2425 | 125 | 2300 | -£42,966 | 5,374 minutes | 99 minutes |

His win/loss ratio is 95%. He wins on 95% of all his trades. You have to admit it. That is a spectacular feat. I am certainly not close to 95%. I don’t actually know anyone who has that kind of hit-rate. It is rare.

At first I didn’t understand how this was even possible. The guy only trades one instrument, which is the German Dax index. He executes nearly 2500 trades over 20 trading days (a calendar month).

That’s 125 trades a day, or 1 every 5 minutes. So how is it possible to hold on to the losing trades for so long?

The answer is incredible.

The guy had discovered that on his trading platform there were two instruments covering the same product. One is called DAX Index. The other is called Hedge Dax Index.

They are 100% identical, and they are based on the same index. However, it is now possible to be long and short at the same time!!!

When he executed a trade, and it went against him by a few points, he would not close the trade. He would do the opposite on the “hedge” instrument.

Then when one of them had a profit, he would close the profitable one and then keep the losing trade open.

He would then hope the losing trade would make it into profitable territory, at which point he would close that trade too. If it didn’t move into profitable territory, he would keep the trade open.

In case you are wondering how many hours 5,374 minutes are equal to, it is 89 hours and 34 minutes. He held on to his losers on average 3-4 days, but his winners he cut after 99 minutes.

He had lost an enormous amount of money because he refused to take a loss. That explains his GREAT ratio between winners and losers.

Is that what you want? A great ratio of profitable to losing trades……or do you want to make money?

What matters most to you? Is it to make money or is it to be proven correct. If it is to be proven right, then you are on the wrong track, and we need to work on that.

Kevin’s aversion to pain is so pronounced that he sabotages all attempts to be a success in trading. Although Kevin’s example is extreme, he is not alone.

The vast majority of traders actually need to work on their “fear response” rather than working on their trading techniques.

This leads me on to the next point in this manual.

Where does it go wrong?

What do the majority of traders have in common?

They are fearful when they should be hopeful.

They are hopeful when they are fearful.

Different people have different problems in the market. As there are an infinite set of possibilities and choices in the financial markets, it stands to reason that we are never going to evaluate each and every one of them. The path to calm and profitable trading is to define our own parameters to live by.

Some of the questions we need to answer are:

- Why do they find it easier to add to a losing position than a winning position?

- Why do they find it difficult to let a winning position run?

- Why do they find it difficult to close a big winning position?

- Why do they find it difficult to close a big losing position?

I will discuss this in much greater detail in a later chapter. For now I am helping you to understand the emotional issues that arise within you, which blocks you from viewing trading as an exciting and stimulating – and profitable endeavour.

Successful trading requires you to be able to handle emotional pain! My argument is that successful trading goes against our natural instincts, but we can train ourselves emotionally to do the right thing over and over. Once you are doing well, you probably don’t feel any emotional pain anymore. There is a possibility that trading becomes quite boring, a bit like flipping a coin, hoping for a particular outcome. It is just a matter of repeating the process over and over.

I don’t feel it as pain, but I found it very uncomfortable to sit in winning trades in the past. It is easier with the losing trades. It is emotionally less painful for the vast majority of people to be in a losing trade. You may not believe me. It may not even apply to you, but the numbers do not lie.

When a trader is in a losing trade, it requires some effort to make the hope go away. It never really goes away, because it is in our nature to hope in the face of adversity. I am certain you are thinking I just made a typo. I haven’t. When you are in a losing trade, the odds are high that you are feeling some pain, but more likely a greater sense of hope.

It is frequently emotionally worse for many traders to be in a winning position than in a losing position, because they can’t stand to see their profits disappear. A friend of mine, a professional trader who suffers from the same problems as everyone else, said to me: “I hate seeing a profit disappear.”

It is for this reason his scoresheet will read a success rate of 85% winning trades but with much bigger losses than profits. When my client John (from the chapter called “NAME OF CHAPTER”) is in a profitable trade, he becomes fearful that the money will disappear.

There is little point in me trying to use reason to make him see my point of view. It would be akin to asking a smoker to stop smoking because I tell him it is bad for him. He knows that. He sees the warnings on the cigarette packages. He sees the horrific images. Yet he still associates greater pain to stopping smoking than he does seeing the warnings and the images.

It is not until he fully desires to stop smoking that the scales tip in his favour. If he uses will power to stop, and uses patches and nicotine chewing gum, then he is merely substituting one form of administrating the drug with another form. That may help him temporarily. For a permanent solution he needs to understand the nature of the smoking trap.

If you want to become a profitable trader, consistently profitable, then you need to understand the nature of the trap in speculation. That will require something rather extraordinary from you.

Kahneman and his team coined an expression which is at the heart of all losing traders. In the field of behavioural finance this theory is called the Disposition Effect:

“Investors are less willing to recognize losses (which they would be forced to do if they sold assets which had fallen in value), but are more willing to recognise gains.

This is irrational behaviour, as the future performance of equity is unrelated to its purchase price. If anything, investors should be more likely to sell “losers” in order to exploit tax reductions on capital gains.”

The disposition effect strikes at the heart of the problem. It is much easier to sell a profitable trade, because it generates a feeling of euphoria in the brain. Selling a losing trade generates a feeling of PAIN in the brain.

The natural conclusion is therefore to decide not to sell the losing trade, because then there is no pain. More importantly, as long as the loss is not booked on the trading account, there is HOPE that the trade will turn around.

Now do you see why trading is so similar to other endeavours in life which are not easy to master? Shall I give you a few examples?

- Losing weight – it’s painful – it requires a firm commitment and the acceptance of short-term pain for the prospect of pleasure.

- Studying for a professional exam – it’s hard work and late nights – it requires a firm commitment and the acceptance of pain.

- Bringing up a child – sometimes we have to tell the child how to behave and it will cry, and we are tempted to give in to stop the crying, or to relieve our guilt or pain, but we persist because we know the child needs guidance and a framework to live by.

I don’t want to make trading into something it isn’t. However, I think there is a big difference between being an investor and being a trader.

First and foremost the time frame is a deciding difference. An investor has the luxury of time and contemplation. If you plan to hold a share for many months, it doesn’t make much difference to your overall strategy if you get your order filled at 51.02 or 51.01

A trader is faced with a very different paradigm. This paradigm is one where you make or lose money very quickly. This introduces a set of pain and pleasure receptors that people outside of the markets can find difficult to understand.

Breaking The Chain

I never gave pain and pleasure much thought until I got hooked on nicotine and then alcohol. I got divorced and I started drinking. Bad habits and addictions (taking away pain) quickly settle into our routine. Quickly I developed a taste for whiskey. Quickly I built up resistance so I could consume half a bottle a night without it seemingly affecting my work.

I did this for 3 or 4 months. I don’t actually remember much about that period of my life. I just remember waking up every morning feeling pain. Drink would relieve the pain. The cycle is complete.

At one point my ex came to see me, shook her head and asked me if this was to be my legacy? Point taken!

She recommended I seek out Alcoholic Anonymous. I went to my first meeting that evening. I went regularly for 3 months, listened and learned.

As I sat in the group of people, night after night, listening to the stories being told, it struck me that I wasn’t an alcoholic, but I DID have a problem which I needed to deal with. Sadly for me AA was not the solution I was looking for. I did not believe I had an illness that was incurable.

I found the solution in a book by Jason Vale called Kick the Drink. I could go into the content of the book (some of which I thought was garbage), but it serves no point here. What serves a point is that I got a deep understanding of dependency and addictions and pain. I won’t bore you with my life philosophy, but I need to get to my point about pain and trading, so read on please.

I should declare that I was also a heavy smoker 18 years ago, and I kicked that for good by getting an understanding of the nature of the nicotine addiction and the amazing trap that it is. This was again achieved by a book, a fantastic one by Allan Carr. I read it from cover to cover twice and then the message sank in.

The solution was simple. You have to understand the nature of the trap. Once you understand the way the brain tricks you into thinking that “just one drink” is fine, then you know what you are up against.

Trust me when I say that I have no problem going to great parties with a lot of free booze, with people smoking around me, without feeling any kind of desire to partake in either. I don’t feel deprived, and trust me again, when I say I am not a bore. I will be the first on the dance floor to show off my moves.

Trading may not be 100% comparable to the common vices of booze and nicotine. I agree. However, it is not booze and the nicotine that is the problem. It is the brains response mechanism that is the problem.

When the brain tells you that you are missing out and that you are not part of the fun (of smoking/drinking/overeating/sniffing..), then you will deprived. The brain is quite a simple mechanism in that respect. It has one purpose:

TO PROTECT YOU AGAINST PAIN

When your brain tells you not to use a stop-loss, it does so to protect you against the pain of taking a loss. So the perverted solution is to not use a stop-loss, even though this opens up a whole host of problems with potentially catastrophic consequences.

The success lies in the preparation. This manual is preparing you for a “new you”, one that can take losses, one that can run profits. This will require repetition, but it will set you on a completely different trajectory in your trading.

I haven’t smoked for 18 years, but 18 years ago I could not imagine life without a cigarette. I could not envision a restaurant meal where I could not have a cigarette afterwards. Then I stopped. I quit. I didn’t cut down. I didn’t give up anything. I quit. Done!

Trading is not dissimilar. If I am up thousands of pounds on a position, my pleasure brain is screaming and kicking for its fix.

FEED ME, FEED MY EGO, I WANT TO FEEL GOOD ABOUT MYSELF!

What the brain is really hoping to achieve is to protect you from the pain you will experience if some of your open profits disappears. It wants to be relieved of the pain of uncertainty and recreate mind equilibrium.

Incorrect trading is similar to cravings from an addiction. You do something now which feeds an instant need, but at the expense of your long-term health.

It seems to me that we have two brains. There is a conscious brain that control our body and mind, and a subconscious brain who somehow can manipulate what the conscious mind is thinking. My brain is good at disguising its messages about taking profits.

When I am in a losing trade it wants me to not take my loss. The way it achieves that is by sending me signals such as:

- Don’t close the position, there is a double bottom here, the market will hold, just give it a bit more time.

- There is no way this market can move down anymore, look how far it has already come down, buy some more, then your average price is much better.

- There is a Fib level here with a trendline – hold on – the market will bounce.

- If it turns here, and moves back down again, you will lose a lot of your profits.

- If you close it here, you can make up the loss from the last trade.

- Have you seen the piece on Oil from Goldman Sachs, they predict it will rise $5. Why are you short now? Take your profits and move on to something else.

Does this sound familiar? It doesn’t matter if I am winning or losing, the mind consistently wants me to do the opposite of what constitutes good trading.

What made the two books I read about alcohol and tobacco so great was their repetition. There is no magic cure to stopping drinking or stopping smoking. There is no magic to trading well either.

There will be some pain in the beginning because you are changing your behaviour. The strength of the books about smoking and drinking lay in their ability to make you understand the nature of the trap, the dependency of a drug, and to make you believe that in no time at all things would get better.

It was the constant repetition of how easy it really was that made the difference. Yes, they acknowledged that there would be some challenges ahead, but they gave you the tools to handle them.

The strength of this manual lies in giving you an understanding and knowledge why you are doing what you are doing, from as many angles as possible, and provide you with a path to follow.

Know your enemy and his tricks and you can defeat him. This manual is written with the purpose of giving you the knowledge to trade how you know you can trade. It is neither hard to trade well, nor is it easy. It just is!

Once you have the understanding, it will be no more difficult to trade correctly than it is to say no to a pipe of crack cocaine after a good meal.

The strength of your conviction is the best armour against the doubters and detractors, whether internally or externally.

Following on from this you will benefit from an awareness of Cognitive Dissonance.

Cognitive Dissonance

In psychology, cognitive dissonance is the mental stress or discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time, performs an action that is contradictory to one or more beliefs, ideas or values, or is confronted by new information that conflicts with existing beliefs, ideas, or values.

As traders we live and breathe conflicting information all day. Leon Festinger’s theory of cognitive dissonance focuses on how humans strive for internal consistency. An individual who experiences inconsistency (dissonance) tends to become psychologically uncomfortable, and is motivated to try to reduce this dissonance—as well as actively avoid situations and information likely to increase it.

When John is in a losing trade (as you will see shortly), he becomes hopeful that the market will turn in his favour. Instead he should be fearful that the market will move further against him.

The last trade we saw John execute gave him a few points. I asked him how he felt when 15 minutes later the market was 25 points lower. John was silent for a moment, and then he replied. “I don’t remember how I felt. I was just so desperate to get back in again”.

I asked him if he regretted closing the trade. He said he did. He said he wish he had not been so anxious to protect his profit. He reaffirmed that all he wanted to do was to get back into the action again.

I said to him: You did get into the market again. You got a great trade entry around 10:30. You pretty much nailed the low of that candle. Why did you buy the DAX there? I thought you were negative the market (see chart of the trade below).

CHART NO 5: Trading Dax– Client buys DAX at the exact low – but doesn’t get much out of it.

John replied that he thought there would be support at that price level, which was where the market had broken out to the upside before. I nodded to acknowledge his technical argument.

So I asked him how he felt when the trade went further in his favour after he got out. He said it was his big challenge. He always wanted to protect his profits, and he never let them run out of fear that they would disappear. He kept seeing trades going in his favour whenever he got out with a profit.

Cognitive Dissonance in trading is rife. I have heard hundreds of traders talk about how they think the market will move higher today. When asked if they profited from it, the answer is always no.

There is always an excuse for not being in the market. “I was out.” “I was in a meeting.”

These excuses mask the cognitive dissonance of trading. We may have a strong valid reason for believing the market will move higher but we will not back the idea because we have a strong commitment to avoiding pain, in case we are wrong about the market.

So how is it done? Next we will discuss “Lessons from a great Trader”.

Lessons from the Greatest Trader

I have a very good friend who I consider to be the best trader I have ever met. He far surpasses me and any of my past mentors in trading ability. He has a gift to see the markets as pieces in the puzzle, and he knows how to put them together.

He may not be strong on technical analysis. He may not know all the technical indicators, but is that so critical to success? I think it is important to remember that it really means very little. It isn’t the making of a trader if you can recite all the indicators and all the theory behind technical analysis.

I called him and asked him some questions about his mental framework. I knew there was no point in asking him about his technical setups. He uses a 10 minute chart, and that is it! If it goes up, he likes to buy. If it goes down, he likes to sell. That’s hardly rocket science.

Question:

Why are you so different from other traders? Why are you not tempted to take your profits?

Answer:

I have made a firm decision in my mind that I WILL NOT GUESS.

When I am long the market, I will not guess where the top is. If I am short the market, I will not guess where the low is. I will not guess.

So that means I will never get out right at the top of the move or exit at the low of the move. There are some natural times when I will close my positions. One is if I have given a lot of my profits away. Another is if the market is about to close.

Question:

That’s it? You made a decision to do something, and there is no other option for you?

Answer:

Yes. Maybe the market will move further in my favour, maybe it will not. There is only one way of finding out. That is by being in the market. That is often painful. I expect it to be painful. I expect it to be uncomfortable.

Of course I am tempted at times to cash in, but I do my best to follow the rules I have laid down for my trading. If I don’t do that, then what is the point of trading? Then it just becomes a form of gambling.

Say for example that the Dow is down 300 points in one hour, and it looks like it is slowing down, then I MAY get out of my position, but it is actually quite rare that I will close a position just because it is very weak or very strong.

If Dow is down 300 points in one hour I interpret that as a weak market, and I ask myself if it could fall another 300 points. If I can’t think of a good reason for closing, then I stay in. I often get out of the market by having my stop-losses hit. I move them down as my profit increases.

I trade this way because I don’t want to come to the end of the day and be disappointed in myself.

I have a curiosity that makes me want to explore how far the market can move. I am able to be aggressive in my trading when I need to be. That combination between curiosity and aggression is what makes me stay in the positions.

Let me give you a practical example from today: I am short the DAX in quite a significant way, and my position shows a loss of 30,000 Danish Kroners. Finally the market moves into my favour, and I am now plus 50,000 Danish Kroners.

However, soon after the DAX makes a double bottom and it then prints a large bullish candle. The Dow follows, as do oil. I say to myself: if I was not long now, I would want to be. That is my cue to get out of my short position, even though it meant a loss of 60,000.

Question:

What does it mean to you to do the right thing? You make it sound as if you never have losing trades.

Answer:

Of course I have losing trades. I have many of them. They are part of the game. You can’t trade and not have losing trades. It is important for me to know that I do the right thing – whether it is a losing trade or a winning trade.

The disappointment of not doing the right thing over time is what keeps me from taking profits early. It is what stops me from running a loss so far that it ruins my focus or account. I need to feel I have done the right thing, even though it means I often never get out at the maximum profit potential (but who does!!!!).

The only way I will find out about the top when I am long is with the benefit of hindsight. I do not close my positions based on how much I have made in profit. I close my positions by asking myself a simple question: If I wasn’t already in a long position, would I enter long now. If the answer is yes, then I stay in.

If the answer is no, or if I want to go short, then I close my position. When I look at my trades, it happens at least once a day that I am on the wrong side of a move. My strength lies in two things:

- I am reasonably good at reading charts to know when I am wrong.

- I am very quick to move in the other direction.

It wasn’t always like this. I used to be very opinionated. When I was right, I would make a lot of money. When I was wrong I was stubborn. I knew I had to change some things, and I knew from working with you (me – Tom Hougaard) that the answer wasn’t in the charts.

I have made a decision in my mind to trade this way. I will never get out at the top of my profit, and I have come to appreciate that guessing where the top is (or where the low is, if I am short the market) generally is wrong.

I am much better off financially to stay with my position and get stopped out on my stop losses that I move as the market progresses in my favour. I don’t like it particularly. However, I have come to expect it. I know it will be painful. If it isn’t painful and uncomfortable, then I haven’t “squeezed the lemon” enough on the position.

Question:

Do you use trading strategies?

Answer:

I do and I don’t. For example I am not sat at my desk trying to figure out if this or that indicator is telling me to buy or sell. I don’t work like that. I look at a 10min chart during the day, but I don’t contribute the chart as such to my trading results. I am more of a thinker. I try to envision the market as a group of people. I am trying to see the market as being run by a group of people. Why are they buying? Why are they selling?

I think it is too easy to invent obstacles on a chart, or imaginary ideas based on the chart alone. I prefer to get an idea of why the market is going up or down, and then the chart will support my trade once I am in with a position.

Lessons from a Great Broker

Now that you have heard a great trader’s viewpoints on charts and trading, I thought it would be an idea to hear from someone on the other side of the fence.

How do brokers think? What do they think? Are they interested in us retail traders winning or losing? How do they handle our trades? What do they think about us?

A good friend of mine owns a brokerage in London. He has been a broker for hedge funds. He has worked as a prime broker for global trading institutions. I called to ask him about institutional traders and private traders.

Question:

Is there a big difference between retail traders and professional traders?

Answer:

No! They have the same flaws. The only difference is that the institutional trader has much deeper pockets and can absorb losses for longer. They also tend to have someone watching over them, and this enforces a degree of discipline.

Question:

What is the biggest problem that retail clients have?

Answer:

They rely overly much on technical analysis. They think that chart reading is the only tool they need to make money. This is not true. You need to have an awareness of the world. For example, China announced a shocking set of economic numbers during the night. When we came to work this morning, it was clear that it was going to be a bad morning in the markets. Unfortunately we had clients who attempted to buy all the way down because the chart said that there was support.

These clients have a really good ability to generate winning trades, but when the market shifts up a gear or two due to new economic circumstances, they are notoriously slow at changing trade direction.

Sometimes they do catch on to a shift in sentiment, but they don’t squeeze the most out of the move. If the trend lasted five days, then I can be fairly certain that most of my clients will have participated in the new movement for 1 day and fought it for 4 days.

Question:

Do private retail traders generally manage their money well?

Answer:

I would say it depends on their level of commitment to trading. For many it is just a bit of fun. For others it is their job. As a whole I would say they are slow to increase or decrease their trading size when the market volatility dictates it.

They tend to always trade the same size. It doesn’t matter if it is quiet or there is a storm raging in the markets. They tend to always trade the same size. If they would at least scale down their size when things get volatile, then I think they would stand a great chance of making money.

I would say that the absolute biggest lesson that retail traders have to learn is that the market has a tendency to go a lot further than anyone thinks. I am sat at my trading desk shaking my head when clients are trying to go short the DAX on a day when it is up 150 points.

Why do they do that?

They do it because they think that they can’t buy now, as it has moved up so much already, but since they want to trade, they will go short instead.

On the flipside we have many clients who will constantly look for places to buy the Dow or the DAX on days when the markets are down 1% or 2% or more. Again, I am shaking my head because they tend to do so with very small stop-losses. It means that they bleed their account slowly through a thousand cuts. The problem is that they get lucky every now and then, and that reinforces this behaviour.

Question:

So what do the good traders do which you don’t see so often?

Answer:

The good traders are the ones who buy the Dow even though it is up 100 points. Why not? The market is strong for a reason, and if you have sensible stop-loss, it makes perfect sense.

Retail traders hate buying strength, but they love buying weakness. Retail traders hate shorting weakness, but they love shorting strength.